Featured Experts

Danny Richter

Vice President of Government Affairs, Citizens' Climate Lobby

Danny Richter

Vice President of Government Affairs, Citizens' Climate Lobby

Dr. Daniel Richter is the Vice President of Government Affairs at Citizens’ Climate Lobby (CCL) where he develops legislative strategy and policy initiatives.

He obtained his Ph. D. in oceanography from UC San Diego, but switched his focus to climate policy and established the Washington DC office for CCL, where he has now been for eight years.

Featured In:

In this Episode

Which climate policies will help countries transition to net-zero emissions? What are the pros and cons of these policies, and how does the United States compare to the rest of the world in implementing a carbon price?

Climate Now spoke with Dr. Danny Richter, Vice President of Government Affairs at Citizens’ Climate Lobby, to help answer these questions.

Related Media:

Climate Now: May 25, 2021

Government’s Role in Climate Action with Caroline Spears

Hosts Katherine Gorman and James Lawler interview Caroline Spears, founder and executive director of Climate Cabinet, a nonprofit that helps local, state, and federal candidates run and legislate on climate change. They discuss what the government needs to do

A Climate Change Primer Ep 4

Social Cost of Carbon

How are the benefits of new climate policies weighed against the costs of their implementation? Climate economists and scientists have created a value called the social cost of carbon in order to better understand the cost/benefit relationship of climate polic

Research Ep 1

Net-Zero by 2050

Pledges to achieve “net-zero” emissions are proliferating from companies and countries alike. However sincere these commitments may be, they rarely include specific plans to achieve that ambition. The Net-Zero America Report from Princeton Universi

Episode Transcript

This episode gives an overview of the policy levers that exist to transition to a net-zero future. We will cover:

- carbon pricing, which includes carbon tax, carbon fee and dividend, cap and trade, and social cost of carbon;

- regulation and codes;

- financial disclosures;

- subsidies for renewables; and

- direct investment.

Of all these policy levers, the latest IPCC Special Report states that a carbon price, specifically, is necessary to keep warming to 1.5 degrees Celsius [1]. So in this episode, we’ll focus on carbon pricing strategies, but we’ll get to some of the others in more depth in later episodes.

So what can carbon pricing mean? Well, let’s start with a carbon tax. A carbon tax is a direct, explicit price on carbon. The amount of the tax might be arrived at through an analysis of the impacts of each ton of carbon dioxide equivalent emitted, similarly to the calculation of the social cost of carbon. At the country level, a carbon tax could be implemented at the point of entry, if imported, at the refinery for oil, at the compressor for natural gas, or at the mine for coal. We spoke with Dr. Daniel Richter, Vice President of Government Affairs at the Citizens’ Climate Lobby, about carbon pricing.

Dr. Daniel Richter:

When you add up those choke points in the system – the coal mine, the natural gas processing plant, or the oil refinery – you can get down to about 2,000-2,500 companies, places that would actually have to pay the fee or the tax, and guess what they’re already all paying some sort of fee or tax to the federal government. And so this is really the same employees that they already have on the fuels that they already understand the energy content. So it’s a simple one additional calculation that the same people can do to arrive at the carbon fee or carbon tax that is owed to the federal government.

So, a simple carbon tax of $50 per ton CO2 equivalent in the US could reduce emissions by up to 47% by 2030, as compared to 2005 levels if paired with a 2% increase in the tax year over year [2]. But that is not enough to reach net-zero emissions, so a higher tax rate or complimentary policies would be necessary [3]. Now the downside of a carbon tax may be an unequal burden for lower income households who already struggle to pay their energy bills or who might not have access to renewable energy [4].

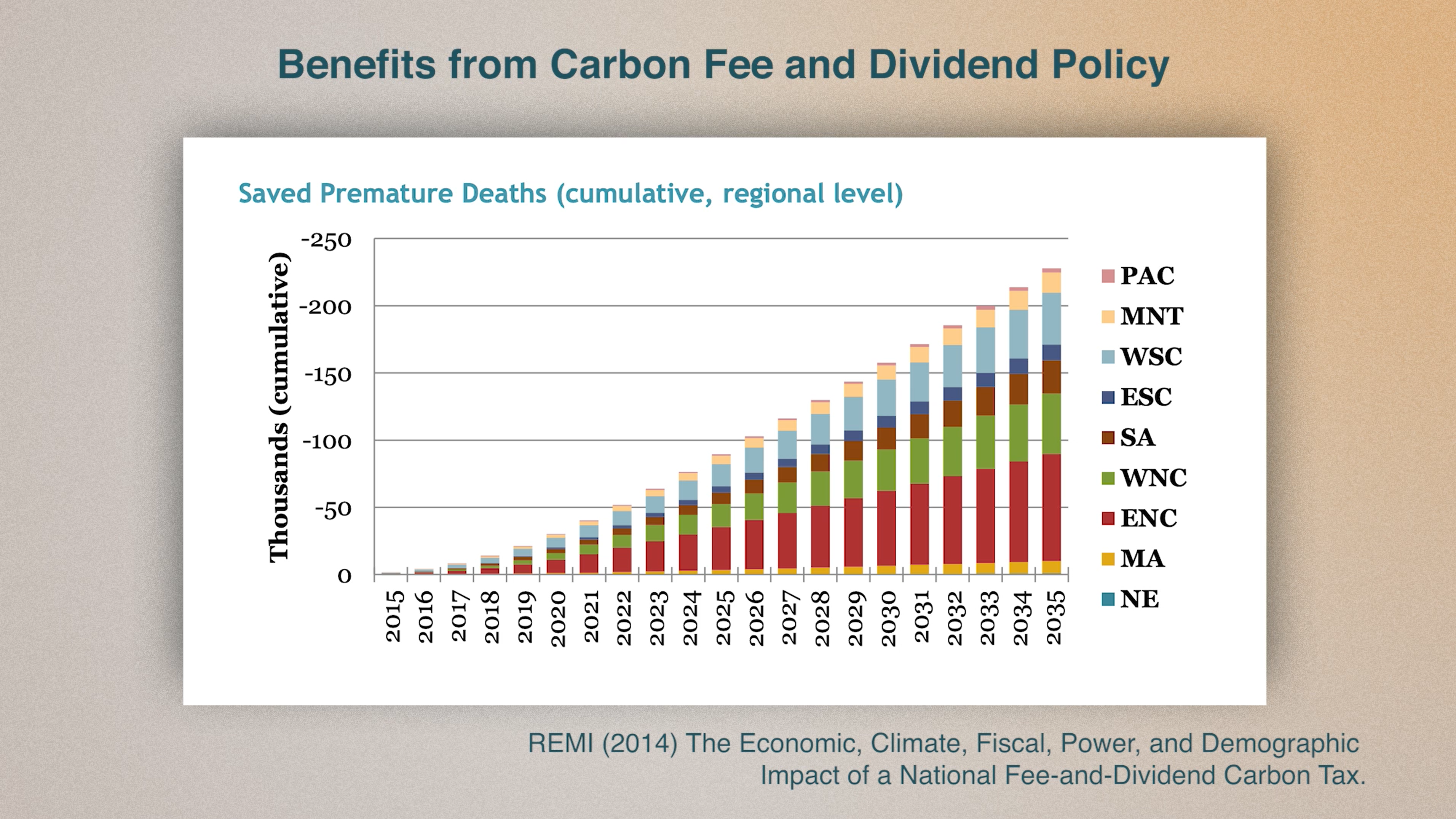

This can be remedied by including a dividend, which would disperse the revenue from the tax back to taxpayers. A carbon tax that is paired with a dividend is considered a Carbon Fee and Dividend if all the tax revenue is returned to citizens. This is a direct explicit tax on carbon. A 100% dividend that is returning all of the revenue from the carbon fee to citizens, minus administrative costs, offsets the unequal distribution of costs that a carbon tax alone imposes [5]. In addition, studies demonstrate that a steadily increasing carbon fee and a 100% dividend policy would significantly reduce greenhouse gas emissions while stimulating job growth and preventing hundreds of thousands of deaths from air pollutants [4, 5].

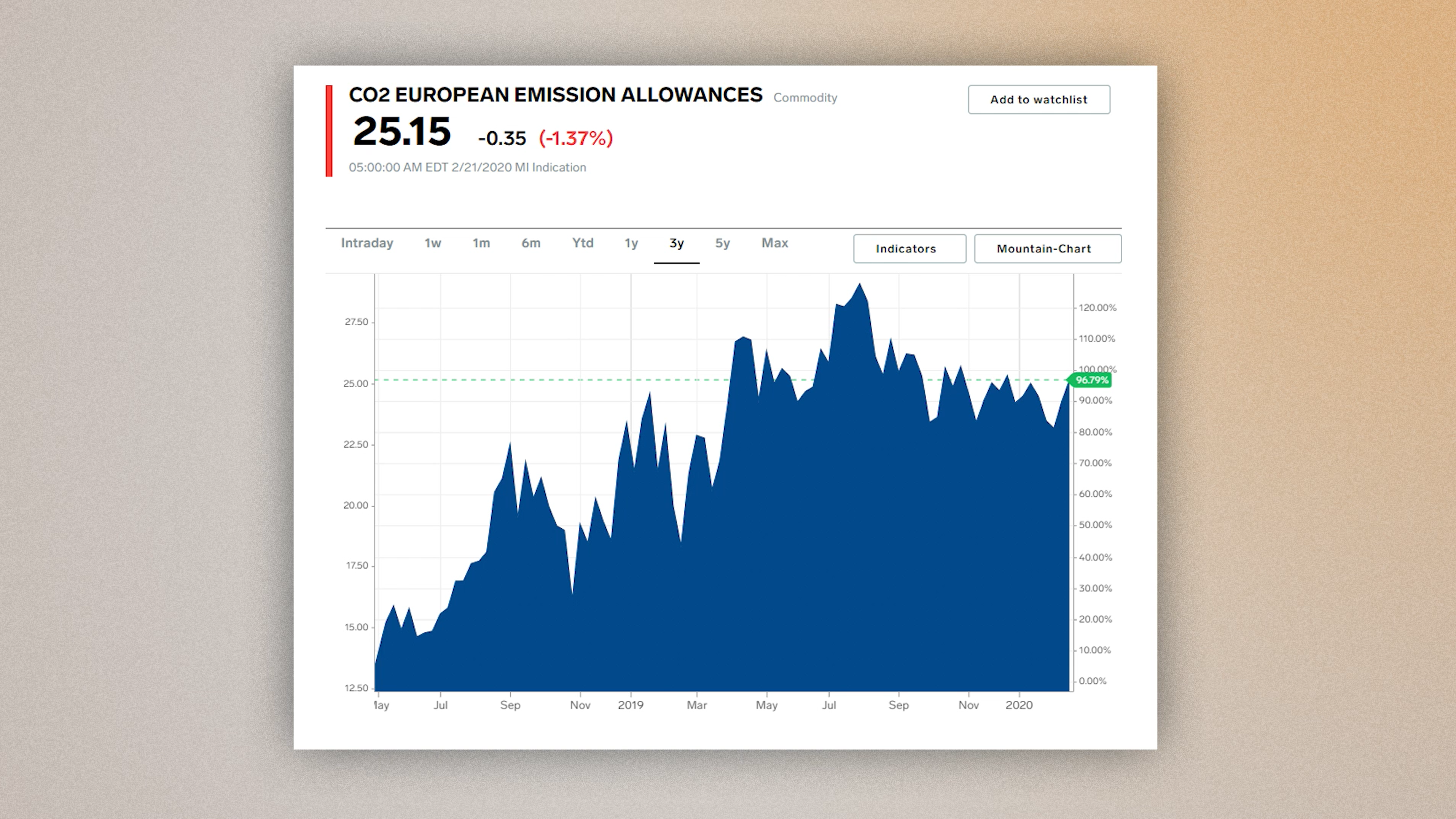

A cap and trade system sets a cap on the amount of emissions that can be admitted in total within a country or sector, and then allows entities to trade emissions credits [6]. Setting a cap implicitly raises the price of high greenhouse gas emission products. As you can see in this graphic, the EU cap and trade system, known as an Emissions Trading System, or ETS, has resulted in an increasing price on carbon [7]. The primary criticism of cap and trade is that often governments simply add more credits or allow companies to continue polluting as long as they pay the fine, which ultimately does not result in significant reductions in emissions [8].

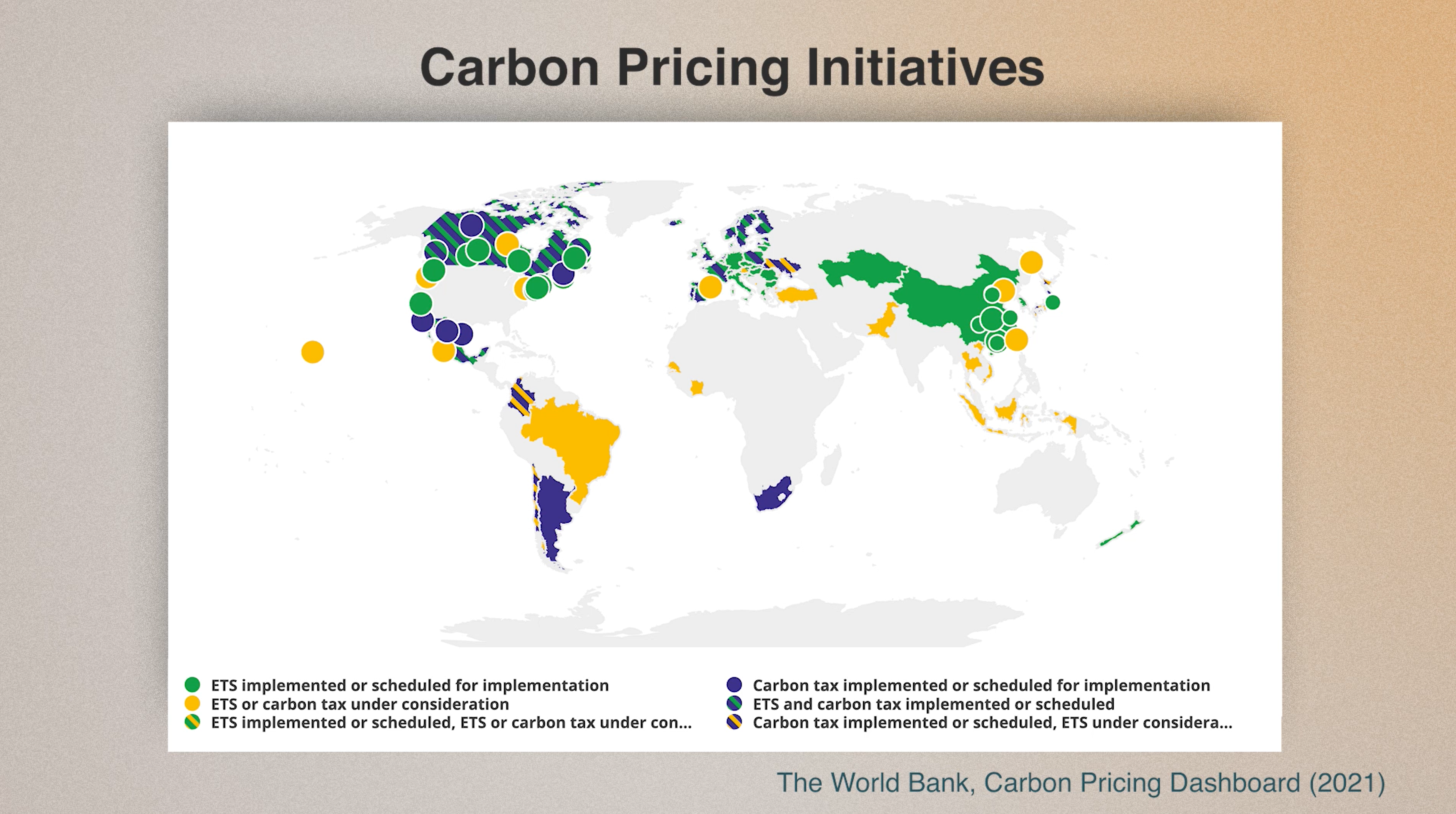

More than 40 countries have implemented some type of carbon price [9] with the first being implemented in Finland in 1990 [10]. This map shows the locations of global pricing policies implemented or scheduled to be implemented, which combined put a price on nearly 12 gigatons of CO2 equivalent in 2021, representing nearly 22% of global greenhouse gas emissions.

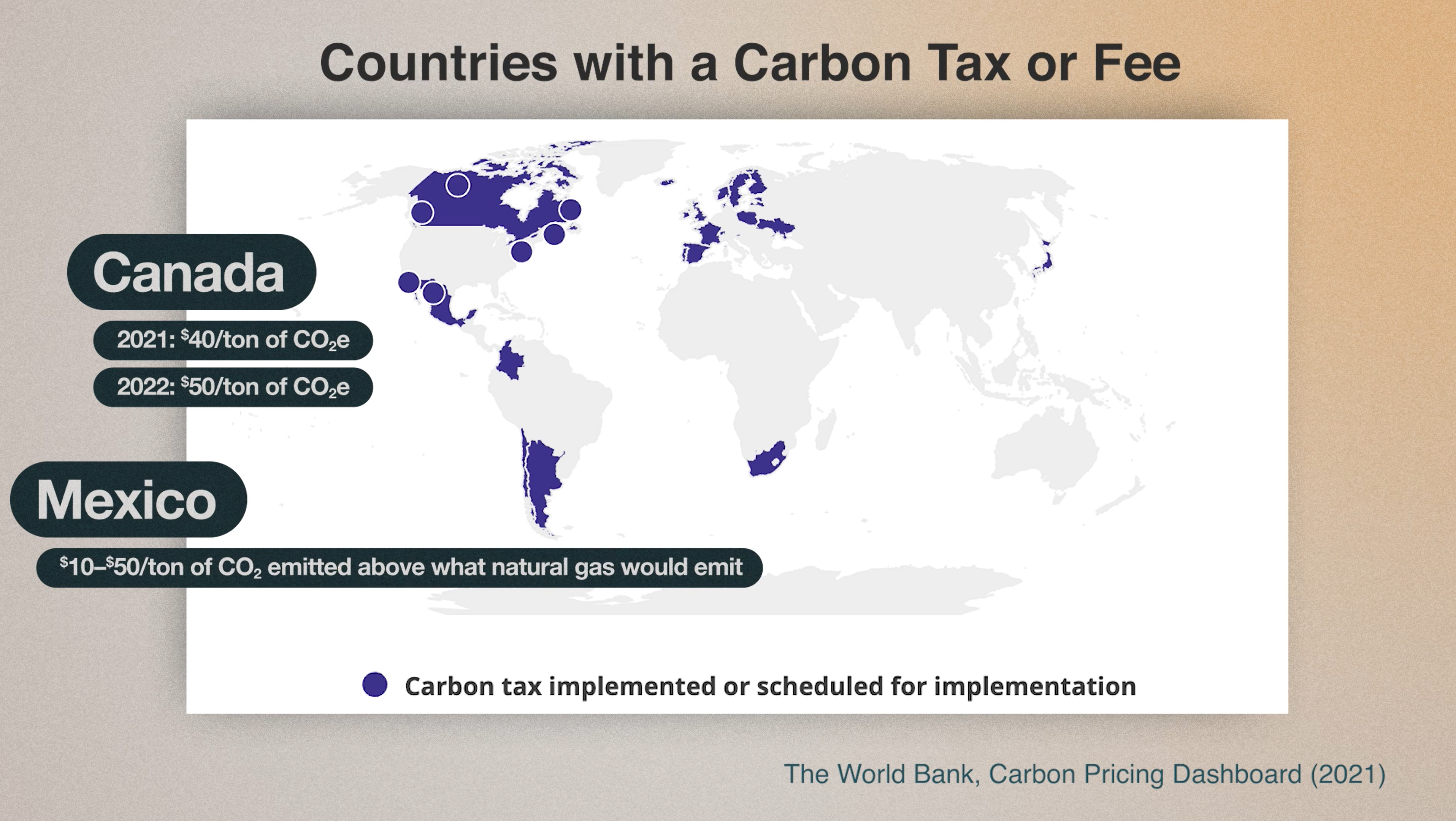

Of those, 25 countries have implemented some type of carbon tax or fee and dividend, including the US’ is closest trading partners, Mexico and Canada. In Canada, the 2021 price is $40 per ton CO2e on fuel, rising to $50 in 2022 [11]. And in Mexico, it’s $10 to $50 per ton CO2 emitted by the fuel as compared to natural gas, which has zero carbon tax [12].

38 nations have implemented a cap and trade system, again including Canada and Mexico, as well as China and the European Union. The United States, by comparison, does not have a carbon fee nor does it have a national emissions trading system.

Dr. Daniel Richter:

The rest of the world is already moving on this. For American businesses, they’re going to have to be subject to carbon prices in our biggest trading partners in the near future. The EU, I mentioned, they have committed to including a carbon border adjustment mechanism. That would be put in place January 1st, 2023. And so that means that this Congress that we’re in right now, the 117th, this is the only Congress that has the opportunity to level the playing field for American businesses [13]. The EU is the largest single market outside of the United States. So the largest foreign market available to United States companies, they’re going to have some sort of border adjustment mechanism. Which means that they’re going to have to pay if they want to sell in the EU.

A carbon fee and 100% dividend, including a similar border adjustment, has been introduced in the US Congress this session, but as of the production of this video has not come to a vote [14, Note: this bill, the Energy Innovation and Carbon Dividend Act has the support of 76 cosponsors and numerous businesses and individuals as of the writing of this, and there have also been other carbon pricing bills presented to Congress and currently in consideration].

The social cost of carbon, which we cover in another episode on Climate Now, is a policy tool used by governments to account for the true cost of carbon emissions when assessing the financial impact of a given piece of regulation, by putting a price on the pollution and warming impacts associated with the emissions that might be avoided by that regulation. The US federal government currently uses a social cost of carbon of $51 per ton, CO2 equivalent in its decision-making [15]. Now, one challenge with carbon pricing schemes such as those we just described is that international carbon pricing encourages trade agreements between countries that have the infrastructure for cleaner production, leaving behind countries struggling to implement green infrastructure.

Regulations and codes are requirements that governments can put on businesses in order to protect the public or keep an even playing field. The Clean Air Act for example, is a US law, which regulates air pollution, including carbon dioxide emissions, to protect public health and welfare. The Act applies emission standards which must be met by car companies, factories and oil and gas companies, or any major sources of pollution [16]. A clean energy standard is another type of climate regulation, which requires electric utilities to purchase a certain amount of low carbon or clean power [17]. Building codes are also an effective climate policy. For example, building codes that require new buildings to be built with more effective insulation and more efficient appliances, reduce electricity and gas use while also saving money for residents [18].

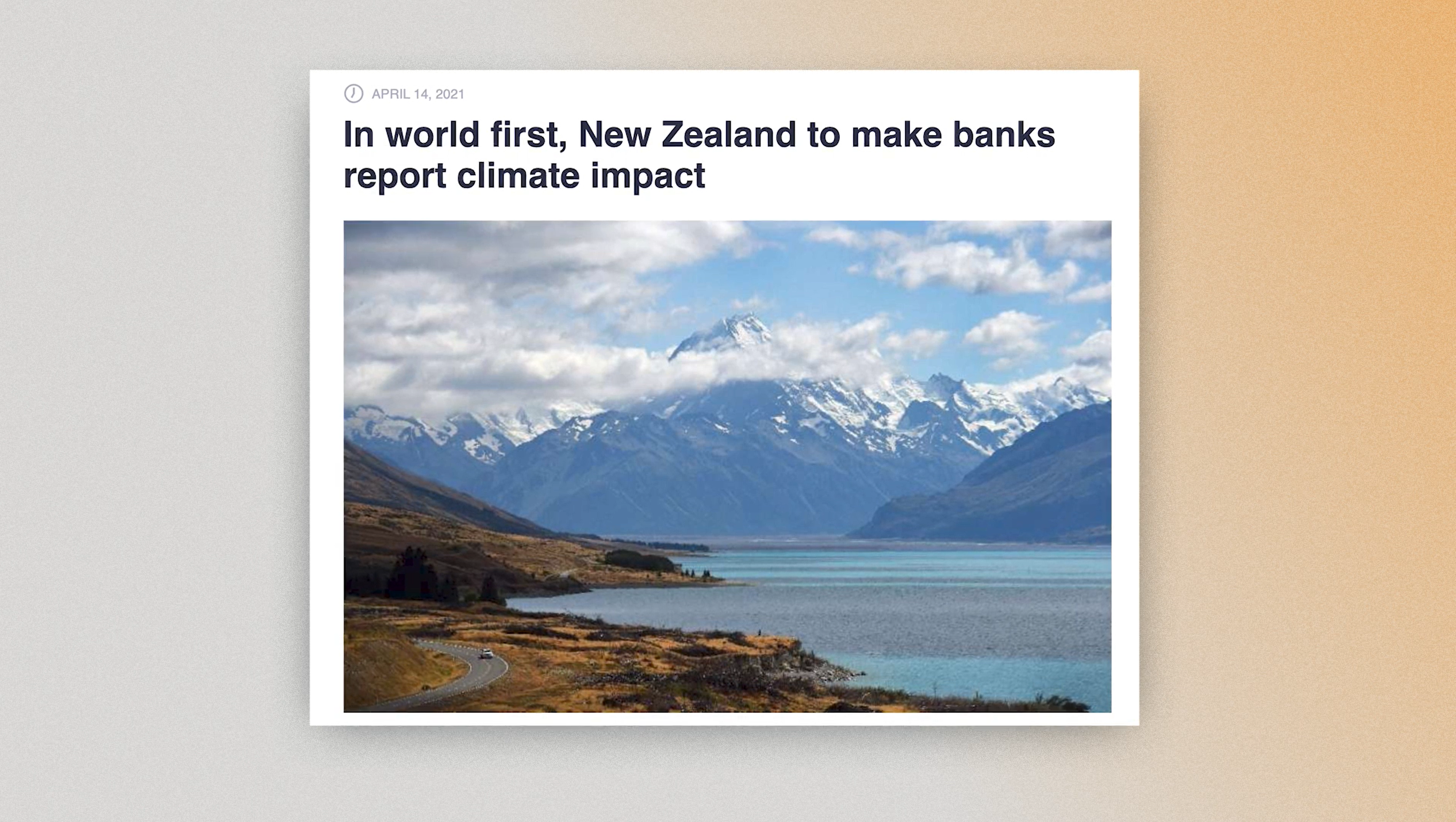

Financial Disclosures. In 2021, New Zealand became the first country to introduce a law that will require banks, insurers, and investment managers to report the impacts of climate change on their business [19]. Doing so, forces these businesses to recognize the impacts their decisions and actions are having on the climate. It also provides information to the clients of those businesses, or investors in them, about the very real risks that climate change poses to their business models. In the US, the Greenhouse Gas Reporting Program (GHGRP), which has been in effect since 2009, requires reporting of greenhouse gas emissions from large sources in the United States. Parties subject to the rule include suppliers of fossil fuels or industrial greenhouse gases, manufacturers of vehicles and engines, and facilities that emit 25,000 metric tons or more per year of greenhouse gases [20].

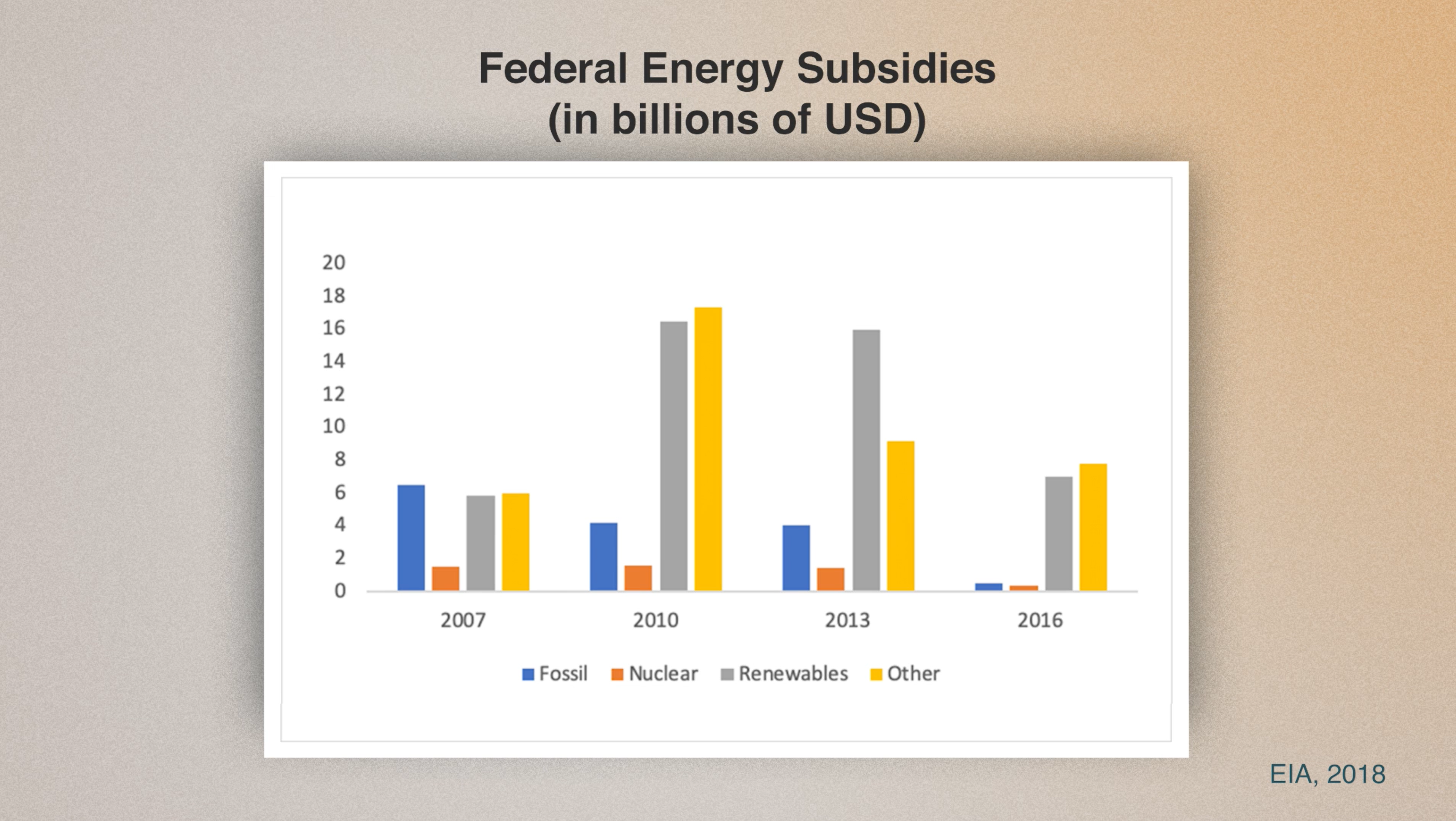

Subsidies enable newer and potentially more expensive – at least initially – technologies to have an equal playing field in the market and start to scale. They encourage specific technologies or economic sectors to grow. This graph from the Energy Information Administration shows how the US has subsidized fossil fuels, nuclear, renewable, and other sources of energy [21, 22]. These subsidies have encouraged development of renewable energy supply. Subsidies might be provided to individuals or businesses as a tax credit, such as an electric vehicle subsidy, or as a rebate, for instance, when buying energy-efficient appliances [24, 25].

Like subsidies, direct investment encourages a specific technology or industry. Governments give grants or financial support to research and development programs that might increase efficiency and technologies that might have a harder time finding funding through traditional investment mechanisms [27]. The EU, for instance, is investing in hydrogen development in an effort to support future energy storage infrastructure [28].

Policy will play a very powerful role in the transition to a net-zero world. Markets alone, which have no way to account for the true cost to society of greenhouse gas emissions, will not be sufficient. Although some might argue that climate policy will slow economic growth, this has not been proven to be true in practice [29], and major businesses are now pushing for strong policy action.

In the US, on April 13th (2021), 310 US businesses, including many of the largest businesses, including Google, McDonald’s, Ikea US, Apple, Microsoft, Nike, among others, signed a letter to president Biden, urging climate action [30]. The US and countries around the world have set emissions reduction commitments in line with the Paris agreement, and they will only be achieved if supported by policy [31]. We’ll go into more detail on some of those policies in future episodes. Meanwhile, listen to our podcast with Dr. Danny Richter on our website at climatenow.com. Thank you and hope to see you next time.

Episode 1.5 Climate Policy Levers Sources

1. Rogelj, J., D. Shindell, K. Jiang, S. Fifita, P. Forster, V. Ginzburg, C. Handa, H. Kheshgi, S. Kobayashi, E. Kriegler, L. Mundaca, R. Séférian, and M.V. Vilariño, 2018: Mitigation Pathways Compatible with 1.5°C in the Context of Sustainable Development. In: Global Warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty [Masson-Delmotte, V., P. Zhai, H.-O. Pörtner, D. Roberts, J. Skea, P.R. Shukla, A. Pirani, W. Moufouma-Okia, C. Péan, R. Pidcock, S. Connors, J.B.R. Matthews, Y. Chen, X. Zhou, M.I. Gomis, E. Lonnoy, T. Maycock, M. Tignor, and T. Waterfield (eds.)]. In Press. https://www.ipcc.ch/sr15/chapter/chapter-2/

2. Larsen, J., et al. (2018) Energy and Environmental Implications of a Carbon Tax in the United States, Rhodium Group for Columbia SIPA Center on Global Energy Policy. https://rhg.com/research/energy-and-environmental-implications-of-a-carbon-tax-in-the-united-states/.

3. Bataille, C., et al. (2018) Carbon prices across countries. Nature Clim Change 8, 648–650. https://doi.org/10.1038/s41558-018-0239-1

4. Kaufman, N., et al. (2019) An Assessment of the Energy Innovation and Carbon Dividend Act, Rhodium Group and Columbia SIPA Center on Global Energy Policy. energypolicy.columbia.edu/sites/default/files/file-uploads/EICDA_CGEP-Report.pdf

5. Nystrom, S. and P. Luckow (2014) REMI & Synapse for Citizens’ Climate Lobby, https://citizensclimatelobby.org/remi-report/

6. EDF, How cap and trade works. https://www.edf.org/climate/how-cap-and-trade-works

7. Business Insider, Markets, CO2 European Emission Allowances accessed 6/29/2021 from https://markets.businessinsider.com/commodities/co2-european-emission-allowances/euro

8. Song, L. (2019) Cap and Trade Is Supposed to Solve Climate Change, but Oil and Gas Company Emissions Are Up, ProPublica. https://www.propublica.org/article/cap-and-trade-is-supposed-to-solve-climate-change-but-oil-and-gas-company-emissions-are-up

9. The World Bank, Carbon Pricing Dashboard (April 2021) https://carbonpricingdashboard.worldbank.org/map_data

10. Partnership for Market Readiness (PMR) 2017. Carbon Tax Guide: A Handbook for Policy Makers. World Bank, Washington, DC. License: Creative Commons Attribution CC BY 3.0 IGO.

11. Government of Canada, Canada Revenue Agency, Fuel Charge Rates (Last updated 3/31/2020) https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/fcrates/fuel-charge-rates.html

12. World Bank Group. Putting a Price on Carbon with a Tax, Background Note. https://www.worldbank.org/content/dam/Worldbank/document/SDN/background-note_carbon-tax.pdf

13. Molyneux, CG, P. Balás & P. Mertenskötter (2021) Twelve Things to Know about the EU Carbon Border Adjustment Mechanism. https://www.globalpolicywatch.com/2021/06/twelve-things-to-know-about-the-upcoming-eu-carbon-border-adjustment-mechanism/

14. Press Release from the Office of Congressman Ted Deutch (April 2021) Major Carbon Fee and Dividend Bill Reintroduced in the House. https://teddeutch.house.gov/news/documentsingle.aspx?DocumentID=402941

15. Technical Support Document: Social Cost of Carbon, Methane, Nitrous Oxide, Interim Estimates Under Executive Order 13990 (February 2021) https://www.whitehouse.gov/wp-content/uploads/2021/02/TechnicalSupportDocument_SocialCostofCarbonMethaneNitrousOxide.pdf

16. US Code Title 42, Chapter 85, Clean Air Act https://www.epa.gov/clean-air-act-overview/clean-air-act-text

17. Mass.gov. Clean Energy Standard Guide (2021) https://www.mass.gov/guides/clean-energy-standard-310-cmr-775

18. Myers, A. (2020) Building Codes: A Powerful Yet Underused Climate Policy That Could Save Billiions. Forbes.

19. Clark, D. & J. Shaw. (April 13, 2021) NZ becomes first in world for climate reporting. https://www.beehive.govt.nz/release/nz-becomes-first-world-climate-reporting

20. US EPA Greenhouse Gas Reporting Program (2009) https://www.epa.gov/ghgreporting

21. Marsters, P. (2019) You Asked: How Much Does the US Subsidieze Renewable Energy Versus Fossil Fuels? Columbia Climate School – State of the Planet. https://news.climate.columbia.edu/2019/09/23/energy-subsidies-renewables-fossil-fuels/

22. EIA (2018) Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2016 https://www.eia.gov/analysis/requests/subsidy/

23. US Department of Energy (2021) Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles. https://fueleconomy.gov/feg/taxevb.shtml

24. US Department of Energy, Incentives and Financing for Energy Efficient HomesEnergy Saver. https://www.energy.gov/energysaver/services/incentives-and-financing-energy-efficient-homes

25. Energy Star (2021) Federal Income Tax Credits and Other Incentives for Energy Efficiency. https://www.energystar.gov/about/federal_tax_credits

26. EIA (2018) Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2016. https://www.eia.gov/analysis/requests/subsidy/

27. US Department of Energy (2021) DOE Awards $6.2 Million for Cutting-Edge Research for Efficient Hydrogen Gas Turbines. https://www.energy.gov/articles/doe-awards-62-million-cutting-edge-research-efficient-hydrogen-gas-turbines

28. Shrestha, P. (2021) EU bank and Portuguese Government join forces to boost investments in hydrogen. Energy Live News. https://www.energylivenews.com/2021/04/16/eu-bank-and-portuguese-government-join-forces-to-boost-investments-in-hydrogen/

29. Murray, B. (2015) British Columbia’s Carbon Tax Seven Years Post Implementation: Has the “Textbook” Policy Delivered on Its Promise? Duke Nicholas Institute for Environmental Policy Solutions. https://nicholasinstitute.duke.edu/content/british-columbias-carbon-tax-seven-years-post-implementation-has-textbook-policy-delivered

30. Open Letter to President Biden (April 13, 2021), We Mean Business Coalition and Ceres Press Release. https://www.wemeanbusinesscoalition.org/press-release/businesses-investors-support-u-s-federal-climate-target-open-letter-president-biden/

31. NDC Interim Registry as of June 29, 2021. UNFCCC. https://www4.unfccc.int/sites/ndcstaging/Pages/Home.aspx