Climate Now Episode 107

July 24, 2023

What happens after forests burn?

Featured Experts

Grant Canary

Founder and CEO, Mast Reforestation

Grant Canary

Founder and CEO, Mast Reforestation

Grant Canary is Founder and Chief Executive Officer of Mast Reforestation which was established by the team as a parent company to DroneSeed. The company is provides no upfront cost reforestation after wildfire and supplies seed and seedlings through its subsidiaries Silvaseed and Cal Forest, manages planting crews, and is able to provide financing by utilizing carbon offsets. Grant has focused his entire career on sustainability—working at Vestas wind energy in China, the US and Denmark, and for the US Green Building Council in its infancy. He founded Biosystems Co., in Bogotá, Colombia that utilized food waste to feed insect larvae for use as industrial fish feed— alleviating overfishing pressure and utilizing food waste. He worked with the acquirer to scale that company to a 60k square feet insect protein factory.

Featured In:

In this Episode

2020 was a record breaking season for forest fires in California. Over 4 million acres burned, releasing enough CO2 into the atmosphere to wipe out the prior 18 years of emissions reductions progress in the state. Effective forest restoration and management can make forests more resilient to the increasing threats of climate change: drought, fire and insects, and help ensure that the carbon trapped in those forests stays there. But who should pay the cost of restoring and maintaining those forests?

Mast Reforestation is a company that replants and stewards the regrowth of fire-ravaged forests of the western U.S., many of which cannot grow back without intervention. Their work is paid for by forest carbon credits, a contentious practice of offsetting corporate or personal emissions by paying to grow and/or protect forests that sequester atmospheric carbon via photosynthesis. We sat down with CEO Grant Canary to discuss why active forest regeneration is necessary, whether forest carbon credits are an effective way to pay for that work, and what the alternatives could be.

Related Media:

Climate Now: Oct 12, 2021

Do you get what you pay for? Monetizing Forests via Carbon Credits

A rapidly expanding list of companies have announced plans to go “carbon neutral” or “net zero”. Often, these plans include at least some offsetting of greenhouse gas emissions by purchasing credits from forest carbon offset programs. B

Climate Now: Nov 14, 2022

The financial value of healthy ecosystems

How many crises can we address at once? In October of this year, headlines broke that the global animal population in 2018 is 69% smaller than it was a half century ago, in 1970. It is the latest bad news in a string of studies on biodiversity loss, which is

Technologies Ep 4

Carbon Dioxide Removal: Forests

Planting trees has become a bit of a cliché in the fight against climate change, with ubiquitous photos of presidents and CEOs planting a tree to show they’re serious about climate. But, how much impact on atmospheric carbon dioxide can tree planting re

Climate Now: Aug 16, 2021

Optimizing Reforestation to Mitigate Climate Change with Susan Cook-Patton

Trees are an incredible resource for mitigating climate change, with myriad environmental benefits – not least their ability to remove carbon dioxide from the atmosphere and store it for hundreds to thousands of years. Reforestation – the process o

Climate Now: Dec 25, 2023

The Voluntary Carbon Offset Market (2/3)

Join us for the second of our three-part series on voluntary carbon offset markets, where we take a look at three companies that have very different strategies for removing carbon from the atmosphere. Vesta aims to increase the amount of atmospheric carbon tha

Episode Transcript

TRANSCRIPT

James Lawler: [00:00:00] Welcome to Climate Now, the podcast that explores and explains the ideas, technologies, and the solutions that we’ll need to address the climate crisis and achieve a zero emissions future; I’m James Lawler. To sign up for our newsletter, which go goes out every Tuesday morning with the link to the latest podcast episode, as well as the link to the transcript, background information and other things, go to climatenow.com.

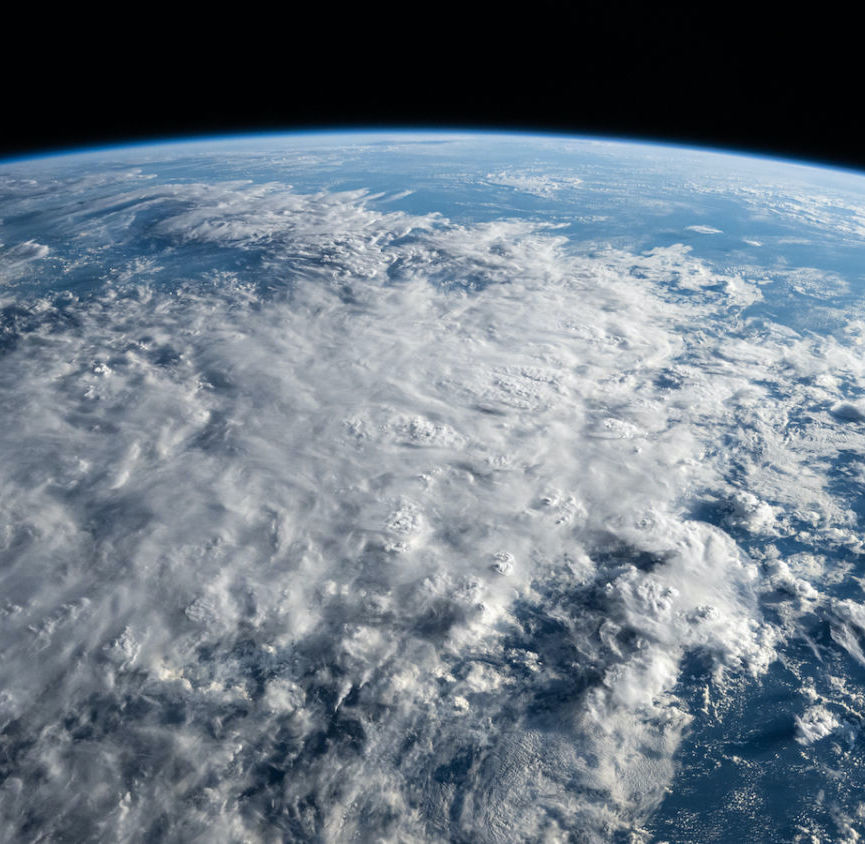

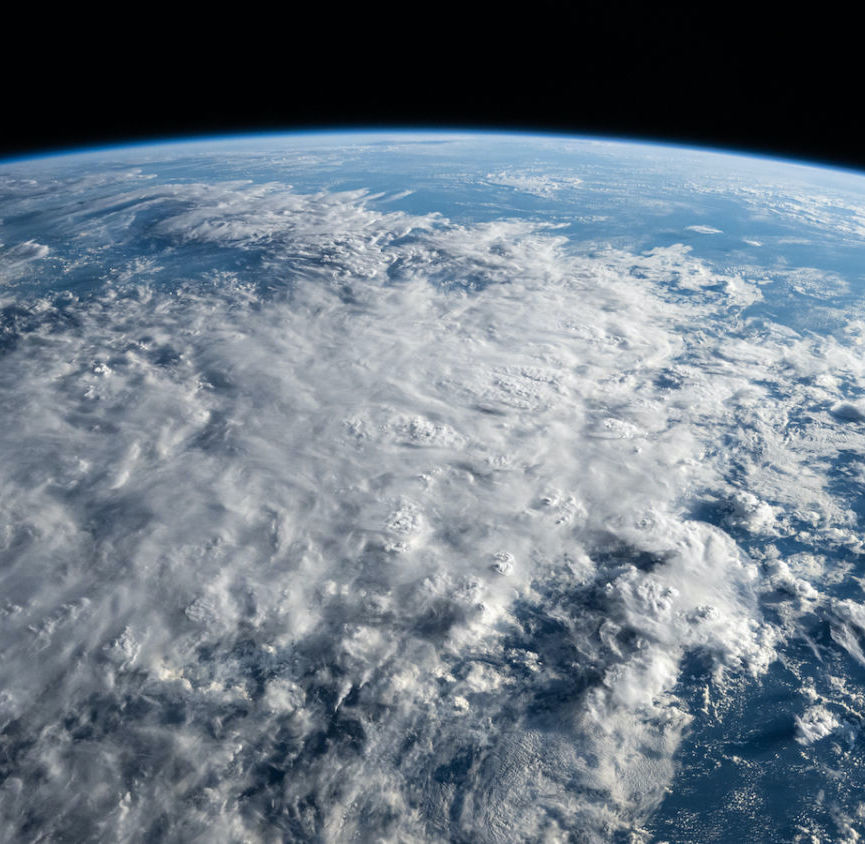

To get in touch with us, you can email us @contactclimatenow.com. We love to hear from our listeners. For today’s episode, what happens to forests after the trees burn? You may have seen the apocalyptic photos of the fires or breathed in the smoke from the Canadian wildfires that have been raging. There’s over 900 fires that are currently out of control and are sending smoke at regular intervals down across the entirety of the North American continent. Wildfires have increased in size and destructive power in recent years as climate change makes conditions hotter and drier. These fires are not only exacerbated by [00:01:00] climate change, They also contribute to it.

The journal Environmental Pollution published a study, which was reported on in the fall of last year of 2022 by the LA Times, and they reported that California’s record breaking fires in the 2020 fire season released 127 million metric tons of CO2 into the atmosphere. That was nearly double the amount of CO2 that state programs had managed to eliminate over the past 18 years.

Now my guest today is working to bring these scorched forests back to life, and to renew the land’s potential for locking up carbon in the process. Grant Canary is the founder and CEO of Mast Reforestation. It’s a company that replants, cultivates, and maintains wildfire ravaged forests. It measures the carbon that is sequestered by those forests over time, and sells that carbon as an offset on the voluntary carbon markets.

We’re going to learn about how all of that works exactly during our conversation. Carbon offsetting, especially offsets related to [00:02:00] forestry projects, is a controversial issue, and it’s one that’s received a lot of attention in recent years, including on this podcast. Concern is especially warranted in light of millions of acres of carbon offset designated forests burning in the West, and the promise of more burning as climate change worsens.

In our conversation today, we explore why forest restoration is necessary, but we also tackle the questions around whether carbon offsets are the right kind of mechanism to sustain this work, and whether alternatives exist now or might exist in the future. First, it’s time for our news segment, This Week in Climate News. This Week in Climate News, I’m joined by the one and only Julio Friedmann. Julio, welcome back. Been a while.

Julio Friedmann: It’s a delight, as always. Glad to be here.

James Lawler: So Julio, we’ve got a lot of news this past week, you know, perhaps the biggest climate story is that the US and China have agreed to revive climate talks.

[00:03:00] What do you make of this story? What exactly has been agreed? What, what is happening between the US and China now on climate, right?

Julio Friedmann: So the US and China together are 40% of the world’s emissions. There’s simply no solvent for climate unless the US and China are in it to win it. And that will require some partnership, some joint efforts, there will be friendly competition as well.

All of that requires dialogue and discussion. So the fact that we’ve had now many cabinet level people, Tony Blinken, Secretary Yellen, and now John Kerry in China reflects both the commitment that the United States administration is doing to this, but also China’s willingness to re-engage in these talks.

I think it’s helpful to keep hopes low. I think low expectations is going to be better. Part of that is simply that there’s a long, long way to go. So even though there was a commitment to continue dialogue, there was a commitment to work together better. At the same time, Xi Jinping gave a [00:04:00] very public pronouncement that said China is going to do this at their own pace and in their own way.

Frankly, the United States is saying similar kinds of things. So I remain optimistic about this. Having been in these kinds of discussions, sometimes talking is enough. And certainly in the preparation to COP 28, a rich dialogue is essential if there’s going to be any progress there. So I think it’s baby steps, but I still think it’s good.

James Lawler: There were several outlets that reported on this, but Bloomberg in their article, they quote, one of the points of agreement between China and the US is that we have to be reducing coal faster, which is interesting, you know, given the amount of coal that’s coming online and projected to come online in China, that they would even agree to that. That seems pretty positive.

Julio Friedmann: This year we reached an all time peak for coal, 8 billion tons. So there’s no solving for climate unless we get that down super fast either. It is forward in China’s plans and it is forward in China’s mind. They are cagey [00:05:00] about this. Part of the reason they’ve built so much coal recently is because they were having brownouts.

They have built by far the most renewable power of any nation. They have been really good about building transmission and distribution networks, doesn’t matter. They’re still falling short of their energy demands. So even with, say, 50% or 60% capacity factors in those plants, they’re still building them.

And it’s simply because otherwise they can’t meet the demand when they need to. And with the scorching high hot temperatures we’re seeing around the world, including in China, they are using more electricity to run air conditioning and cooling. As always the devil will be in the details and progress will be hard won and incremental.

James Lawler: Yeah.

Julio Friedmann: If you care about climate you should be voting for people who care about climate simple. We have made incredible progress with this administration between the bipartisan infrastructure law the amendments to the 2020 Energy Policy Act. Of course, the IRA, the CREST Act, all kinds of things have really contributed [00:06:00] to bending the curve. And a lot of that work could be undone for a decade if in fact the next administration doesn’t go for it.

So honestly, I’m, I’m less partisan on this. There are Republicans, I think, who would do a very good job and treat this seriously. I think the Democrats have a clearer record of success on this and commitment to this, but either way, you got to be voting for candidates who care about this.

James Lawler: Yep. So moving to another story, Exxon announced a 4.9-billion-dollar purchase of Denbury. And we want to talk about this because of how it might change the sort of developing carbon capture and storage landscape.

But first, I wonder, Julio, if you could set the table here, what is Denbury for those who don’t know? And why is this a strategic acquisition for Exxon.

Julio Friedmann: So Denberry is a pretty small independent oil and gas producer. They don’t have sort of downstream assets. They don’t have refineries. They basically produce oil and gas.

One of the things they do have in their assets though is [00:07:00] a huge CO2 pipeline. They have a CO2 pipeline that stretches from Northern Mississippi to the city of Houston. That CO2 pipeline moves carbon dioxide from a naturally occurring CO2 dome in Mississippi and adds anthropogenic sources along the way from hydrogen plants and so forth.

That asset in a carbon constrained world becomes a big deal, just the ability to move large volumes of CO2. The fact that that CO2 pipeline right of way crosses really good places to store CO2. Frankly, I’m surprised that somebody didn’t buy Denbury earlier. And the fact that Exxon did this, A, shows that carbon capture is going to be a thing. B, I think reflects Exxon’s commitment to reduction of emissions using that. And third, it’s going to create a bunch of consternation.

For those who are paying attention, Denbury’s pipeline through Mississippi is also the site of the Satartia disaster, where a landslide caused a failure of [00:08:00] that same pipeline. And both hydrogen sulfide and CO2 were released and caused a whole bunch of health problems in a small town. It is a totemic example of environmental injustice. So the fact that Exxon bought this is going to rile a bunch of people up, and that’s fair, frankly.

James Lawler: Right. Makes sense. So I want to pivot to the story about all of the heat that we’re experiencing around the world, breaking records and contributing to, you know, the roughly thousand out of control wildfires that are raging in Canada and now in Southern Europe.

It seems like this is maybe turning a corner, at least in some minds about the seriousness and the rapidity at which we’re, we’re seeing the changing climate impact, real lives, infrastructure, economic activity, and all of these things that scientists and others have been talking about for many years.

Julio, how do you process everything that we’re seeing today in terms of the weather and those impacts?

Julio Friedmann: So 10 or 15 years ago, I remember [00:09:00] conversations where people were saying, well, maybe we should just adapt to climate change. People aren’t saying that anymore. We must do adaptation, but they’re not saying, Oh, we’ll just adapt as if it’s a casual, easy thing.

People are starting to understand just how expensive, just how damaging climate change is. And it is killing people. It is displacing people. It’s damaging ecosystems. People are starting to understand the scale and the impact. That said, I’m not particularly optimistic. We’ve had climate disasters every year for as long as I’ve been alive.

And people, people keep hitting the snooze button. I do think, however, that mostly it’s shaken up the gumball machine of people who run countries and people who run companies because those two groups of people can’t be cavalier about it anymore. The impacts have come home to voters. The impacts have come home to infrastructure failures.

The impacts have come home in a way that [00:10:00] requires a response. It’s affecting profits, it’s affecting shareholders, it’s affecting those people hard. Companies and investors have to take this seriously.

James Lawler: Yeah.

Julio Friedmann: And as a consequence, people will vote with their feet on money and on infrastructure and investment.

James Lawler: So I want to get to our last story. Geothermal company, Fervo Energy, had some, had some interesting news this past week. Uh, Julio, could you tell us what’s new with Fervo?

Julio Friedmann: Absolutely. So let me start by saying geothermal has been underinvested and underrepresented for a long time. It’s one of those things that if you can get it, the returns are enormous.

And the challenge with geothermal has always been how do you get the heat out? It seems like Fervo has made some real progress on this. This is a company based in Houston. They have a novel drilling and completion scheme as well as novel drilling technology. They have a lot of sensor and control and operational sophistication. And they’ve basically said, Hey, we’ve [00:11:00] created an open loop system that allows us to actually harvest the energy from rocks in general. You don’t have to go to a super hot brine field like most geothermal, uou can do this lots of places.

Right now their project is smallish, a few megawatts. Looks promising. Other companies have said this in the past, we’ll have to see how robust this is. It is not clear how economic it will be, still, it’s a big milestone. If it proves true and they can really produce quality heat from what we would typically call enhanced geothermal systems or hot dry rock or these similar sorts of things that represents a real breakthrough.

James Lawler: And they, they’ve announced construction on a 400 megawatt project. They expect it to be online by 2028 and we’ll see if that’s true. This is in partnership with Google, so that will be interesting if they can hit that target in Northern Nevada is where they’re building that.

Julio Friedmann: Frankly, the key issue here is if you can get super low [00:12:00] carbon electricity on demand in lots of places, that’s going to matter a lot.

And this kind of abundant energy is the sort of thing that we should be thinking about how to better harvest. The innovations that have come from this have come from 30 years of investment at the Department of Energy, many companies that no longer exist that tried stuff and failed, all of this is stacked to the point where now maybe Fervo has made it work.

And if they have, if their 400-megawatt pilot does the job, awesome. If it doesn’t, we’ll learn from that and keep going.

James Lawler: Yeah, I think that’s a great point, Julio, about sort of the stacking of innovation and all of this sort of, you know, all of the failed attempts and all of the learning and all of the funding at the federal level that has gone into producing the knowledge base and the skills necessary to make these breakthroughs.

And that’s really something that sets the United States apart from other countries, is our national lab system. If you’re interested in that, you can listen to an episode we did with Kate Gordon, who has actually just this past week left [00:13:00] the Department of Energy, but she gave us a great rundown of exactly how the Department of Energy works and how it funds our, our national lab. But Julio, it’s great, great having you as always. This is a really fun conversation.

Julio Friedmann: Look forward to next week.

James Lawler: Now for our interview. In the mid 2010s, Grant Canary was working on ways to make tree cultivation more efficient and cost effective. He eventually launched a company that used swarms of drones to reseed wildfire scorched territory. That drone project would eventually lead to the formation of Mast Reforestation, which is the company that Grant leads today.

Wildfires are, of course, a natural part of forest ecosystems. They’ve been around since we’ve had forests but climate change is making those fires steadily worse and worse. And Grant explained how forests that would normally return on their own are being lost for good. We opened our conversation with Grant, learning more about his background and also about the state of [00:14:00] Western American forests and how fires have impacted them in recent years.

Well, Grant, welcome to Climate Now. It’s great to have you on today. Thanks for joining us.

Grant Canary: Excited to be here.

James Lawler: Tell us what is Mast Reforestation and how did you come to start the company?

Grant Canary: Yeah. So I guess the relevant points here are everything I’ve done has been in sustainability in my career trajectory.

So US Green Building Council, you know, that organization that puts the stamp on the side of the buildings, it says, hey, they’re, they’re LEED certified for platinum gold, whatnot. Um, got started there. Other home energy certification companies, Vestas wind energy, I did change management projects for executive teams in Beijing, Denmark, United States for, for two years on a, on a development program with them.

James Lawler: Okay.

Grant Canary: And then very non-traditionally went abroad, got a master’s degree at Universidad de La Sabana in Bogotá and built a company out of my master’s thesis at the same time, uh, taking food waste, feeding it to insects, [00:15:00] turning it into protein for industrial fish feed based off of-.

James Lawler: Amazing.

Grant Canary: Yeah, right. Like, yeah. Picking up from kind of taking food waste, feeding it to insects, I really- I left that company. I really wanted to focus on removals. I wanted to focus on what we’d already put out into the atmosphere. I had been part of a very big tree planting project, a consulting team, uh, out of house working for JP Morgan to scale up a 20-year United Nations pilot project.

And I’d seen how it, uh, was done there and wanted to see how it was done in my home country, the US. And one of the things that really, really popped out was the big pain point around the difficulty of the terrain, especially in the western 11 states. A lot of mountains and the places that still have forests are the places that aren’t farmland, and they aren’t good for home development, etc.

And so that’s where the trees are. And that means that people were running up and down hillsides, planting trees. And so this is 2015, [00:16:00] 2014, you know, drones are new on the scene at that time. So we got started as Drone Seed and that was just kind of like the first, the first step.

James Lawler: Grant started a company in 2016 called Drone Seed, which used drones to fly over these landscapes and deliver hockey puck sized seed pouches that would protect seeds and give them time to grow. But Grant and his team hit a roadblock: seed availability.

Grant Canary: Right now, there’s not enough seed, there’s not enough seed supply, given the rise that we have seen in the size and severity of wildfires, and the lack of regeneration that’s occurring naturally now because those, those more severe fires, like a lot of people come at it well, you know, forest burns, forest regrows, yeah. But with a high severity fire, temperature, it burns several inches down into the soil, and that’s where some of those seeds are stored that are dormant, waiting to become the next forest, and those seeds are destroyed.

So those are the big black clouds coming off the [00:17:00] fire. A lot of that is organic matter, the topsoil being burned off. And so, high severity fires, destroying the seeds, no seeds to come back.

Low severity fires, which are part of the natural ecology of sites, they go through and they’re like a crème brûlée. And the seeds are all happy and fine in the soil and they become the next forest. So when we do reforestation under climate action reserve methodology and some of the pieces we’ll get into, we are focusing exclusively on those moderate to high severity burns.

And that is where our additionality comes from. These forests wouldn’t come back otherwise.

James Lawler: And I, I do want to get into that methodology and the funding structure that you’re referring to when you mentioned the Climate Action Reserve. But first, when we say these forests wouldn’t come back, how much forest are we talking about and what is the scale of this problem?

Grant Canary: So just to put some numbers on the acres and the tons, the acres… 10 year average. So we’re not cherry picking any data, from 82 to 92 was something along 2. 5 [00:18:00] million acres is what the average was that burned in the United States per year. Fast forward to present day, we’re now at like 7. 5 million acres is the 10 year average from 22 looking back.

And this is from the National Interagency Fire Center, so you can go check those. That, that 5 million acre increase in the average. Is about the size of state of New Jersey in terms of fire tonnages, there was a, it was covered in the LA Times off of one of the scientific papers that came out, they looked at it and they said the 2020 California wildfire season emitted something like 127 million metric tons of carbon into the atmosphere.

And the 18 years of policy wins of, of EVs and different energy sources and other things to reduce emissions was something like 65 million metric tons. So one fire season wipes out 18 years of hard fought, you know, wins in the space. [00:19:00] That’s just devastating. And then, you know, to kind of tie a bow on that, well, most people are saying, well, that’s, that’s really awful, but the forest will grow back. And I guess what we’re trying to say is without human intervention, a lot of those forests are not coming back.

It used to be 90% of the time for us would come back. Now we’re seeing that drop, you know, broad brushstrokes here, 40%-60% the time. So that’s a lot of acreage that all of a sudden is not restoring that carbon that was emitted in the fires, and so that’s something where we absolutely need the opportunity to get in there and intervene.

James Lawler: By intervene, Grant means that Mast Reforestation handles every step of the restoration process. From planting new trees to long term maintenance. The company has three subsidiaries. DroneSeed, which was the original company that Grant started, which offers aerial seeding services. SilvaSeed, which is the largest seed supplier in the western US. And finally, CalForest Nurseries, which supplies trees for [00:20:00] California reforestation projects.

So Mast Reforestation represents a combination of these three entities, sort of a vertical integration of this reforestation space. For example, for a recent 3, 000 acre project in Montana, Mast Reforestation hired tree climbers to gather pine cones from healthy forests, process and cultivate the seeds in its nursery, and then replanted the saplings in the burned area.

Where does the revenue come from that allows Mast Reforestation to do this?

Grant Canary: It is not, despite a dollar tree campaigns and such, there’s a lot more than just the tree that goes into the labor, the site preparation, et cetera. So a couple thousand acres can be 4 or 5 million to reforest. And where does that money come from? Carbon removal credits. Without carbon removal credits, there’s no money for our work with reforestation. There’s no money for, uh, ocean based removals. There’s no money for biochar. There’s no money for direct air carbon capture. That is the system that pays for this [00:21:00] work. And without that, it’s government grants that may or may not scale to the size of the problem that we’re really seeing.

James Lawler: So as a buyer of carbon credits, I’m exchanging dollars for effectively a promise. You know, if I’m buying a certain amount of tonnage, you know, to be captured from the atmosphere and stored permanently, that’s the contract that I’m signing up for. And so let’s say that I do this and I fund reforestation of a forest, which is reforested.

Mast comes in, uses that money to plant a bunch of trees on some acres that were severely burned. And you, you reseed, you replant, but there isn’t rain then the next season or the next two seasons or new insects come in or the fire comes back in that area and those trees are burned or they’re, they’re dead.

What happens with that carbon credit that I’ve purchased? Because, you know, clearly the carbon was not stored, right?

Grant Canary: Yeah. Before, before we get into the details of how do we [00:22:00] manage for the permanence, how do we manage for those risk factors? Let’s just like acknowledge, like, yes, some carbon credits just completely are not moving the needle on mitigating the worst effects of climate change, they suck.

But there’s 177 types coming from a hundred plus countries. So I think the nuanced view that I want to bring to people is, while there have, while there’s definitely criticism warranted of some of those, we’re in a place where there are a number of different types of carbon credits, and it’s important to start to analyze and figure out what are the ones that are moving the needle and what are the ones that are, that are not?

I’m a big believer in what gets measured gets done, right?

James Lawler: Yeah.

Grant Canary: And I think a lot of people want to see that, that, that traction and actionability. Here’s how we do it under Climate Action Reserve, which is that very first thing, like there’s a hundred plus years of monitoring.

So the way that the project site works is land manager is impacted by wildfire. What do I do? Um, talk to us. Okay. [00:23:00] We, we’ve solved the capital problem. We’ll offer reforestation at no upfront cost. We can do that because we have a lender that will loan money against the carbon removal credits. And so great now we-,

James Lawler: Sorry who’s the lender?

Grant Canary: Carbon, carbon streaming.

James Lawler: Carbon Streaming Slider, okay. They’re lending you the upfront capital to do that. Got it. Okay. And so, so when you sell the credit What kind of permanence provision is, is in that sale? Like, how long are you saying that the carbon that is, you know, going to be stored will be permanently stored when you sell a credit?

Grant Canary: Yeah, we’re, we’re rated for 200 years. I think Pachama and others make a really credible argument that the, the life of a tree might be 50, 100, 200, 500 years. But the life of a forest as a larger organism, when we have a low density forest, which results in low severity fires most often, then we can have a forest that can be much longer. So as a part of the project, what occurs is that there’s an easement that’s placed on the land.[00:24:00]

This is within the United States, so that is a right that’s held by a land trust, and it’s a nonprofit third party to a minimum quantity of trees per acre. And so, um, as part of the project setup costs, they’ve got a right for a hundred to 200 years, depending upon the state. To that minimum quantity of trees per acre that sits, uh, at the county. So they want to, some landowner wants to sell the property, move on, what not. That sits with the property. Now, a hundred years is a long time and that right is only good if somebody is monitoring.

So as part of the project setup costs, there’s an endowment similar to any university, Harvard, Yale, Stanford. It’s invested in the market, provides a percentage return. And that pays for a site visit every five years for the next hundred plus, and a site report every year. That right now is boots on the ground and that’s what that endowment pays for. There’s tax benefits for those landowners as well, depending upon state, county, federal law, where they’re at.

And so that’s something [00:25:00] that’s really beneficial in that regard.

James Lawler: That sounds good. But what we’re selling in the contract is carbon removal, right? We’re not selling that you’re going to get for these dollars and minimum trees per acre on a certain number of acres. Like you’re selling carbon removal. So how do you guarantee carbon removal in a stand of trees?

Even, even, uh, let’s consider that we’re not actually talking about individual trees. We’re talking about forest, but, what happens if it burns before they’re 50 years old and the carbon that you think you’ve stored is gone? What happens then?

Grant Canary: Yeah, well let’s go let’s go back to the credit issuance. So we planted the trees.

James Lawler: Yeah.

Grant Canary: Now we wait, and we wait a year. And the reason we wait a year is because there’s a lot of campaigns out there that have been like we planted in 100,000 trees, or whatever. You plant them with the wrong root angle, you plant them in the wrong place, they’re gonna be all dead.

So, uh, there’s a minimum of one year wait that Climate Action Reserve requires. So then Climate Action Reserve’s like, all right, great, [00:26:00] we’re going to issue some credits. But before they do, they’re like, hey, we realize there’s this risk of a reversal, which is a nice industry term for fire, insects, ice, other things that can kill trees.

So we’re going to take a portion of those credits and we’re going to put them into a, you know, a buffer pool. Every project contributes into this pool. And if there is a reversal, then our buyers know that the credits are either coming from the pool or they’re coming from the project, one of the two. And then, then the question is like, well, the fires are going to go up. Uh, yes.

And what insurance companies do in this case, they increase premiums. So increase the percentage that goes into the pool. This is how we do risk management and abatement, is we have projects and they balance each other out in the total tonnages by that. And then the landowner has that, uh, capital from the carbon removal credits that if they are impacted, they can go out there and reforest.

James Lawler: Very interesting. Do you think there should be a different class of credits that apply to ecosystem services rather than carbon? Because carbon is so [00:27:00] specific, but the value that like, let’s say you guys, you know, Mast is providing, yes, you’re providing carbon removal, right, as the trees grow, but you could make the argument that you’re also providing a lot of other things, right?

As these trees grow, they’re, they’re helping all kinds of, all kinds of stuff. Species flourishing, clean water, clean, you know, just aesthetics, like, and all of that has value, right? And depending on who you are and where you are, you would describe different dollar numbers to that. Like, is there, is there any interesting progress on sort of this, you know, the marketplace for ecosystem services credits, because it feels like there should be, and there probably will be if there isn’t already. What are your thoughts on that?

Grant Canary: I think like the, the idea of ecosystem services, I like to think of like the human economy as like this gear that’s spinning at like a thousand revolutions per minute, and we’ve got this like natural economy that, that trees and plants and others like exchanging carbon to manage [00:28:00] like life, et cetera, are spending it like one revolution per minute. And I want to connect those two gears so that we are, we are caring for investing in intervening and, and augmenting, where needed, some of those services that we get today.

James Lawler: Yeah, I really love the metaphor that you have in that visual of these two gears that ideally we could interlock. So when you think about those two gears and that metaphor coming together, you know, what, what, what I think about is then business models. So what, what exactly would drive those two gears to kind of join?

Meaning, the concept of credits, of carbon credits, is that I’m an emitter, and I have a desire, or society is putting pressure on me to, to counterbalance those emissions, and so I buy carbon offsets. I buy sort of the carbon removal work that someone else is doing, and so that I can claim net zero. So that’s the specific driver [00:29:00] of the business that you’re, that you’re doing right now, that’s, it’s a very specific kind of narrow thing, and it’s maybe one of the things that Mast is doing right?

In an ideal world, right, you’d be able to say, okay, this project is going to, is going to do all of these different things, you know, provide all these different ecosystem services with these probability weightings, you know, with this kind of measurement and verification. And so here’s the contract we’re going to do with you.

These are shared benefits, you know, like cleaner air is a shared benefit of everybody. And so should there be a tax for living in a place that has better forest coverage, and then that tax revenue is going to Mast to provide that service or, you know, whatever these projects. How should those gears come together? What are the, what are the market business mechanisms by which this could actually work?

Grant Canary: Well, it’s the de- we’re coming up with the definitions, we’re coming up with the accounting for [00:30:00] this and to the extent that a- where Bloomberg NEF says, hey, price of carbon in two of our three scenarios goes to 200 a ton, by 2030 if we’re focused on removals.

And that’s what we do. We do removals, post fires with trees, but there’s ocean based, there’s biochar, there’s direct air carbon capture. There’s a number of other technologies coming online that remove carbon out of the atmosphere. Which we absolutely need to do because thought experiment, humans are gone tomorrow, like all of the ecosystems would still experience all of the changes in climate because we’ve already locked in, because of what’s already out in the atmosphere, so much warming. And so, we have to do removals and this pays for it and then to your point, like we get all these other ecosystem services.

It’s really exciting because now we start to pay for, care for, nurture these other ecosystems. Clean water services in Portland, metro area, they get paid to plant trees [00:31:00] around the streams and rivers and whatnot because they cool water for fish. They avoid a 100 million plus water chiller plant because fish need cooler water.

James Lawler: Who’s paying whom in that, in that example?

Grant Canary: In that, in that scenario, um, people that are paying their water bill are paying for that as a, as a function of-

James Lawler: Rate payers have a little premium.

Grant Canary: I think I’ve got that right with water and, and I think it’s a combined water/power situation, so yeah.

James Lawler: Okay. So that’s something that gets, that’s something that gets implemented into regulation and the public utility then adds, you know, a few cents or dollars to everybody’s bill every month and that goes on to the tree planters that plant the trees.

Grant Canary: Those are those two gears coming together.

James Lawler: Yeah, yeah, absolutely. Well, Grant, thank you for joining us. This was really great to have you and what a great conversation. Really appreciate your time. Thank you.

Grant Canary: Yeah, deeply appreciate it.

James Lawler: That was Grant Canary of Mast Reforestation. For [00:32:00] more lively discussions about the carbon credit and offset market, check out our previous episodes at climatenow.com. And if you’d like to get in touch, we’d love to hear from you. You can email us at contact at climatenow.com or tweet us @weareclimatenow.

We hope you can join us for our next conversation.

Climate Now is made possible in part by our science partners like the Livermore Lab Foundation. The Livermore Lab Foundation supports climate research and carbon cleanup initiatives at the Lawrence Livermore National Lab, which is a Department of Energy applied science and research facility. More information on the foundation’s climate work can be found at livermorelabfoundation.org.[00:33:00]