Featured Experts

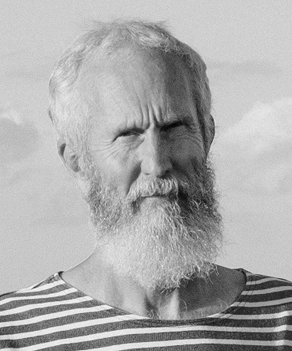

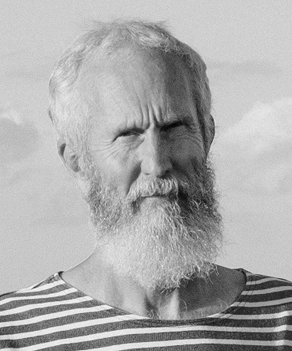

Doyne Farmer

Director of the Complexity Economics programme at the Institute for New Economic Thinking at the Oxford Martin School

Doyne Farmer

Director of the Complexity Economics programme at the Institute for New Economic Thinking at the Oxford Martin School

Dr. Farmer is the Director of the Complexity Economics programme at the Institute for New Economic Thinking at the Oxford Martin School, Baillie Gifford Professor of Mathematics at the University of Oxford, and an External Professor at the Santa Fe Institute. While a graduate student in the 1970s, Dr. Farmer built the first wearable digital computer, which was successfully used to predict the game of roulette.

In this Episode

The recent working paper by Rupert Way, Matthew Ives, Penny Mealy, and Doyne Farmer, Empirically grounded technology forecasts and the energy transition, suggests that the high estimates of the expense to transition to renewable energy have been inflated, and that it may in fact be cheaper to transition to renewables than to stay on fossil fuels, regardless of the costs of the changing climate. Using probabilistic cost forecasting methods, the authors of the paper project that because of the exponentially decreasing cost curve of renewables like wind and solar, fossil fuels will become nearly obsolete in just 25 years.

Climate Now spoke with co-author of the paper, Dr. Doyne Farmer, to better understand their model and predictions.

Related Media:

Climate Now: Mar 8, 2022

A venture capitalist’s perspective on the evolution of green transportation

In 2021 alone, more than $32 billion dollars were invested in green-technology startups, a four-fold increase from five years earlier. But how far will those dollars go? Only about 25% of venture-backed startups actually make the transition from an inn

Climate Now: Mar 22, 2022

How the electricity grid works

One of the most efficient ways to get to a net-zero economy is to generate electricity from renewable sources, and then make as many things run on electricity as possible. But, as more end-use services (transportation, heating, industry) are electrified, and

Technologies Ep 1

Clean Fuel: Hydrogen Fuel

Hydrogen is uniquely qualified as a storage of clean energy because it is abundant – the most abundant element in the universe – and it can be produced using renewable energy. When consumed in a fuel cell, its only byproduct is water, making it

Technologies Ep 8

Wind Energy

In order to reach global net-zero emissions by the middle of the century, modeled pathways project that wind energy will need to be a primary source of electricity, accounting for 19-43% of global electricity production. Today, though, wind produces only 6% of

Episode Transcript

Transcript

[00:00:00] James Lawler: Welcome to Climate Now. I’m James Lawler, and today we’re joined by Dr. Doyne Farmer, who recently co-authored the working paper, “Empirically grounded technology forecasts and the energy transition,” which suggests that the high estimates of the expense of transition to renewable energy have been inflated, and that it may in fact be cheaper to transition to renewable energy than to stay on fossil fuels, not counting the cost of climate impacts.

[00:00:33] James Lawler: Dr. Farmer is the Director of the Complexity Economics Program at the Institute for New Economic Thinking (INET) at the Oxford Martin School. Baillie Gifford Professor in the Mathematical Institute at the University of Oxford and an external professor at the Santa Fe Institute. Dr. Farmer’s past research includes complex systems, dynamical systems theory, time series analysis, and theoretical biology.

[00:00:58] James Lawler: He also designed and built the first wearable digital computer, which he used to beat the game of roulette. So, he knows something about mathematical projections. Dr. Farmer, thanks so much for joining us today. It’s great to have you.

[00:01:10] Doyne Farmer: Nice be here.

[00:01:11] James Lawler: So, Dr. Farmer, you have a very interesting background. I wonder if you could tell us a little bit about what you’ve worked on and how your path led you to your work in renewable energy economics?

[00:01:22] Doyne Farmer: Well, somehow fate caused me to get very involved in various aspects of prediction. And I’ve always been really interested in the drivers of technological progress, and about 15 years ago, Dan Arvizu, who was the Head of the National Renewable Energy Laboratory (NREL), came down to the Santa Fe Institute to ask us to help them think out of the box about what they might be missing, and we had a workshop and I realized that the whole question about what this will cost hinges around technological change and whether we can predict the costs of energy technologies in the future. So, since then I’ve been devoting a lot of my research to that.

[00:02:05] James Lawler: Now, you’ve detailed several scenarios in your paper. You’ve described a Fast Transition Scenario, a No Transition Scenario, and a Slow Transition Scenario. Could you describe each of these, and what would put us into any one of them?

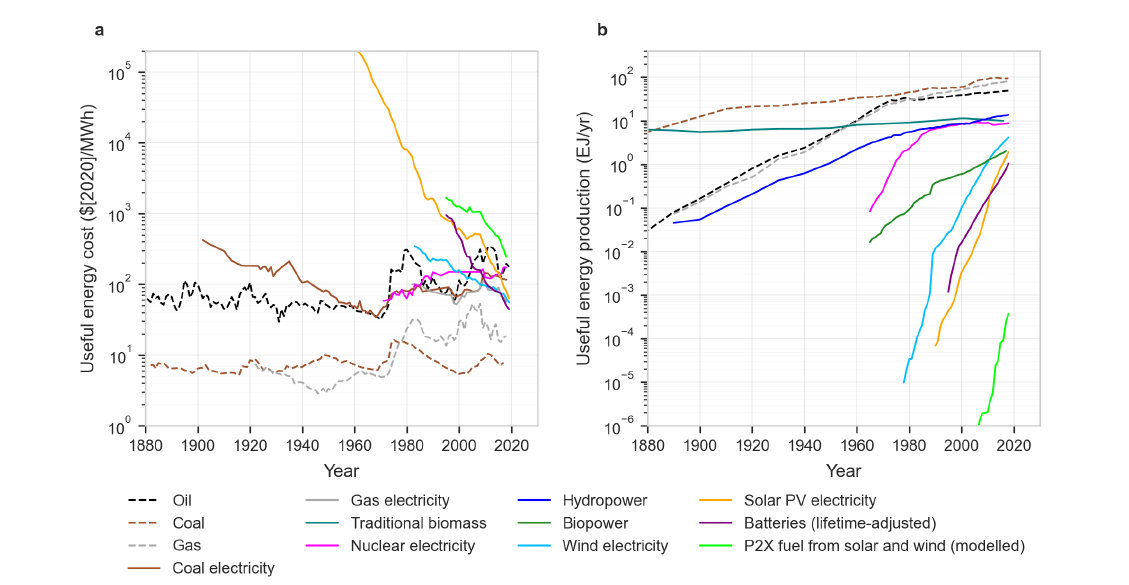

[00:02:25] Doyne Farmer: Yeah, I’ll do that, but I want to actually, if I can, I’d like to first say something else that I think sets that question up, which, if you look in our paper, anybody who’s motivated to go look at it, Figure One is just a historical record of what’s happened in the energy system over the last 140 years, and we show both the prices of the different sources of energy and the deployment rates of the energy. And one of the reasons we’ve constructed our scenarios the way we have is because something that’s very striking from that figure is that you see all these wiggly lines, okay?

[00:03:02] Doyne Farmer: So, we’re looking at, on the X axis we’ve got the year from 1880 to present, and on the y-axis, we have the cost that we’re putting in some standardized units in terms of the cost of generating a megawatt hour of useful energy. And what you can see is coal and oil, those have been going for 140 years, and the costs bounce around a little bit, but the trend is remarkably flat.

[00:03:35] Doyne Farmer: In fact, from a statistical point of view, you can’t prove it isn’t flat. On the other hand, if you look at some other technologies, like solar energy, it’s coming down on this scale, you know, sinking like a stone in terms of costs, since its first use in a Vanguard satellite, solar energy has dropped in cost by a factor of more than 1,000, 4,000 or 5,000.

[00:03:58] Doyne Farmer: That’s a big change in price, whereas oil and gas, they fluctuate by factors of two or three or maybe five or six, but not factors of a thousand. Similarly, nuclear power has gone up in price by about a factor of three since its first deployment in 1957. We’re seeing dramatically different behavior.

[00:04:21] Doyne Farmer: So, now we’re looking at deployment, so do you see going back to the beginning of oil, gas and traditional biomass, and so on slowly building through time, you see nuclear, which initially shot up and then plateaued, and now you see, we have wind, we have batteries, solar, green hydrogen, and electrolyzers, those are all rocketing up at a pace of about 40 percent per year. They’re dropping in price at 10 percent per year and increasing at rates the order of 30 percent or so per year, depending on which era you look at. We’re seeing dramatically different behavior.

[00:05:07] Doyne Farmer: Now, I should stress, this is all on logarithmic scale. These are exponential processes and exponential processes have a way of sneaking up on you, so while at present, solar is still only a few percent of energy supply, wind is a couple of percent, with these exponentially increasing deployments, if it stays on these curves, within 10 years it’s going to go up and hit the other ones, or pass them.

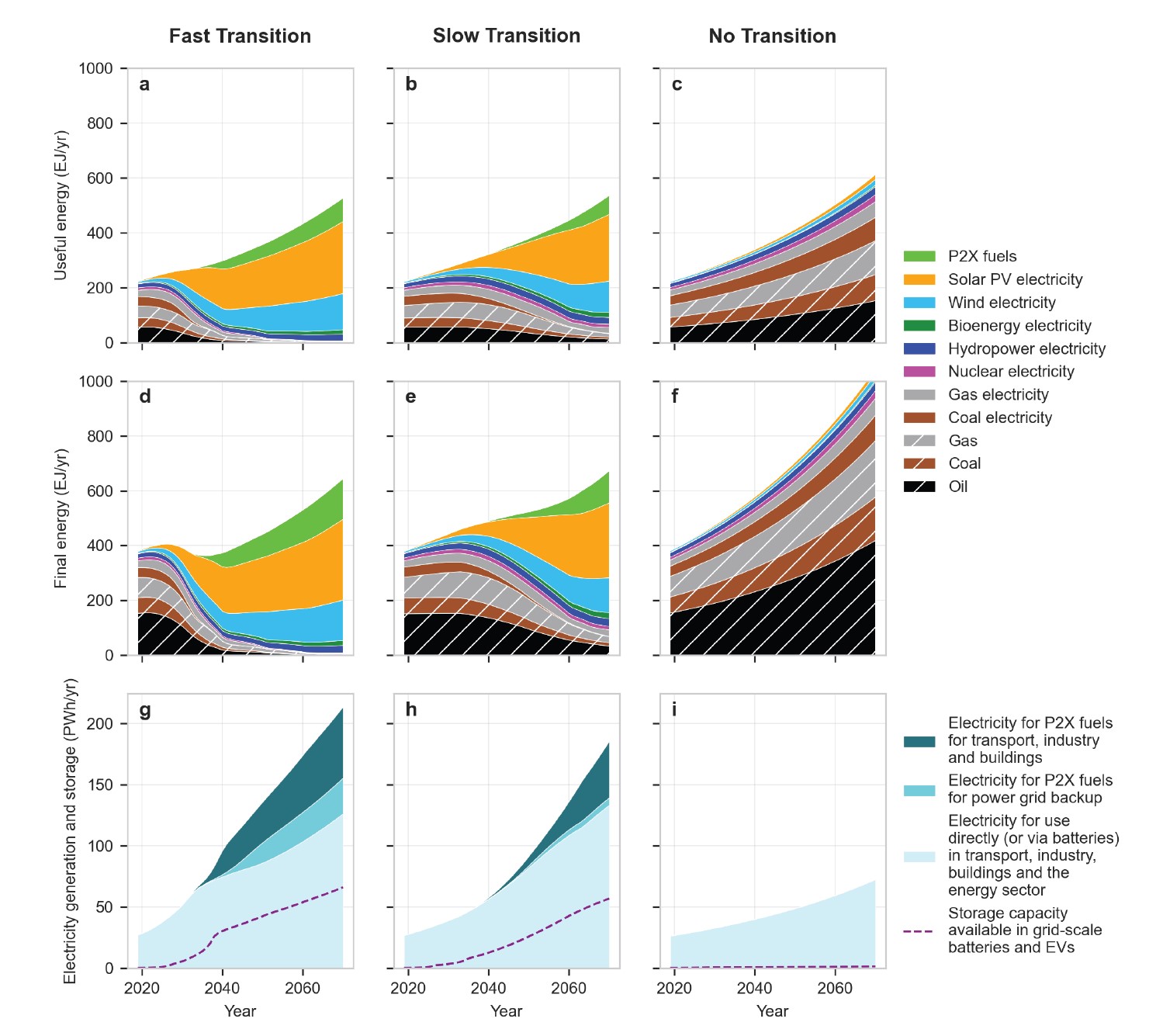

[00:05:37] Doyne Farmer: Back to your question, what are the scenarios? Well, our first scenario, which we call Fast Transition, is a scenario where we just assume we stay on those same trajectories. If wind, solar photovoltaics, batteries, and green hydrogen, and green hydrogen is essential because you can use it to store electricity too for long storage.

[00:06:02] Doyne Farmer: Like, if the sun stops, if the wind stops, you store green hydrogen and you can burn it just like natural gas when you don’t have renewable generation. If those things just stay on their trajectories for another 10 years, and then they start to flatten out because by then, they are at the scale of the rest of the energy system, I mean, they become dominant in the energy system, at that point.

[00:06:29] Doyne Farmer: If they can stay on that trajectory for just another 10 years, then we pretty much solved most of the climate greenhouse gas emissions due to energy generation, which is 75 percent of the emissions for climate change. And secondly, our forecast suggests that because those costs will continue to come down with high probability if we continue deploying, then we should see energy get cheaper than it’s ever been historically.

[00:07:04] James Lawler: I’m wondering, is the projection based purely on sort of the mathematical behavior of these numbers historically? Or is it more empirically based in the other contributing factors to these changes in price.

[00:07:22] Doyne Farmer: It’s more the former than the latter. I mean, ideally as scientists we like to have causal explanations of things. We don’t have a causal explanation. What we do know is that history says that, while you cannot predict exactly what the technological solutions of the future will be, you can predict, once technologies or classes of technologies establish a cost trend, they tend to be very persistent. The most famous example is Moore’s Law. In 1965, Gordon Moore said semiconductor devices were increasing in density, doubling in density, I believe he originally said every 18 months and then he revised his estimate to be two years.

[00:08:12] Doyne Farmer: Because increasing the density of components lowers the cost of manufacturing, increases the speed, and increases the energy efficiency, the semiconductor business has been on a trajectory now for 70 years of shrinkage, so that they’re now hitting the quantum scale and more predictions have been amazingly accurate.

[00:08:33] Doyne Farmer: Now, he couldn’t predict how they were going to do these things, and he couldn’t predict exactly what the solutions would be, but he just noted there was this trend. That’s the most famous example, but there’s another actually older example, due to Theodore Wright, who in 1936, noted that: when planes are manufactured, that the cost of manufacturing a given model of plane coming out of a given factory dropped by 20% every time the cumulative production of the plane doubled.

[00:09:12] Doyne Farmer: That’s called Wright’s Law. The exact number is changed from technology to technology, lots of technologies like oil and coal don’t follow this because the costs have never really come down, but other things like airplanes and solar photovoltaic cells and wind generators, and so on, there are many examples, do follow this with varying numbers of what the percentage in what the cost drops by every time the production doubles.

[00:09:44] Doyne Farmer: For solar energy, it’s closer to a 3,000 drop in price every time the production doubles, and it’s not just specific factories, it really works pretty well for global solar photovoltaic deployment.

[00:09:59] James Lawler: You described the Fast Transition scenario, which is essentially what will happen if we remain on course, if these trends persist in the cost and deployment curves of renewable generation, would you mind taking us through the other two scenarios that you described?

[00:10:14] Doyne Farmer: Sure. We’ve actually looked at even more than that, but so the Fast Transition scenario, in 20 to 25 years, we’ve pretty much gone all the way green. There’s no more carbon emissions twenty-five years from now. From energy generation, I mean, there’s still the last things to go are stuff like cement and steel manufacturing, and those kinds of applications where you really need to generate lots of heat. That’s the fast transition.

[00:10:44] Doyne Farmer: The slow transition, it’s like the fast transition, but slower, which means that natural gas hangs around for a lot longer. What it also means is that the costs don’t come down as quickly because we aren’t pushing things, as they would say, down their learning curve. Under Wright’s Law, if you want the cost of the plane to come down, you got to make more planes because that’s how you learn. Right? You also get advantages of scale, and so forth and we don’t realize the cost benefits as quickly.

[00:11:19] Doyne Farmer: Then we have another scenario, which we is like the business-as-usual scenario, where we assume that, okay, renewables do keep growing, but we just lock in all of our fossil fuel usage from now till 2070. We do that just as a reference.

[00:11:38] Doyne Farmer: We’ve even done one where we assume everything just stays in the proportions it is now, so for generating 2 percent of our energy with solar energy, so we lock that in, so these are in order of how expensive they are, and then the most expensive of all is a nuclear transition.

[00:11:59] Doyne Farmer: So, where we assume that we transition to nuclear power over the course of the next 30 or 40 years, that’s the most expensive of all and why? Well, because nuclear power is expensive, and there is nothing to suggest it’s going to get cheaper.

[00:12:15] James Lawler: Right. That seems to be a view that we’ve explored and we will be exploring more to the lack of a business case for nuclear power. Could you talk about the economic profile of each of these transitions, and basically who realizes each of th benefits under these different scenarios?

[00:12:37] Doyne Farmer: Yeah. Ultimately in every case, it’s the consumers of power who realize the benefits. I mean, power gets cheaper. How are the benefits realized? One of the things that happens in the renewable transition is that a lot of the power system gets electrified because we either use the electricity directly, or we store it.

[00:13:01] Doyne Farmer: Either, storing it in a battery, or we use the electricity to make hydrogen and we either store the hydrogen, or we use the hydrogen to make green ammonia, or there’s a lot of other proposed kind of fuels one can make, and you store those fuels.

[00:13:22] James Lawler: Give us a sense of the scale of these dollars and how that compares to conventional thinking about the cost of the transition.

[00:13:30] Doyne Farmer: Yeah, well, it’s always tricky to say how many dollars something’s going to cost. There’s a difference between spending a dollar now and a dollar in 20 years, so how do you count? Do you count the dollar 20 years from now the same way? Surely people discount future expenditures, and then there’s a lot of fighting about what the right rate should be, so you have to sort of decide what your discount rate’s going to be before you can quote numbers. These numbers should not be viewed as precise numbers, but we expect we’ll save the order of $25 trillion by doing the Fast Transition over No Transition, and the Slow Transition comes out somewhere in between.

[00:14:18] Doyne Farmer: That’s in some net present value terms. In other words, you’re weighting all the dollars we’ll eventually spend, and we are talking about, no matter what, spending a hundred trillion dollars for energy over the next 50 years. Energy is a significant thing. It’s 4 percent of GDP. Global GDP is the order of $80 trillion, so 4 percent of that is like $3.2 trillion a year that we’re spending on energy right now.

[00:14:53] Doyne Farmer: It’s a matter of changing those expenditures, and, in that context, even though we’re talking about spending the order of $300 billion for enhancing the grid, because we think the grid needs to be built out by about a factor of four to make all this happen and to deal with future energy demand, because we’re assuming energy demand just keeps going up at 2 percent per year as it has for the last 30 years. If that continues, to deal with that and to deal with the electrification of the energy system, we estimate it’ll cost the order of $300 billion, which sounds really expensive, but on the other hand, if we make energy 10 percent cheaper, we’re saving that every year.

[00:15:39] James Lawler: So, what do policymakers need to understand about your work, would you say?

[00:15:45] Doyne Farmer: Several lessons there. One is, we do have to pick winners, and we’ve done in the past. Sometimes we pick losers, but we picked a lot of winners, actually. On one hand, we need to invest in multiple things to hedge our bets, but we can’t invest in everything because if we invest in everything, we don’t make progress in anything. You need to pick a few things, and really put investment behind them to make them happen.

[00:16:11] Doyne Farmer: Our paper is contingent on staying on the trajectory that we mentioned. Now, that trajectory has been aided by things like price supports in the past. That said, we should be a little careful because there’s always a lot of noise in the press about price supports for solar energy, wind, and so on, but the number one energy source that receives price supports is fossil fuels, by far. Second is nuclear power. Third is renewable energy sources, so, you know, we do need to keep up.

[00:16:47] Doyne Farmer: The point I was making is that, our predictions are really conditional on staying on the deployment trajectories that we’re on now. We need to make sure that we don’t hit roadblocks that cause that not to happen. One of the potential roadblocks is not enough grid capacity, so we could easily double our energy generation capacity with renewable projects, but the bottleneck is grid deployment, and grid deployment depends on getting permission to do things.

[00:17:17] Doyne Farmer: It depends on politics. Now you’re going down to state and local levels, and so we have to grease the wheels to make the political process, so that we aren’t blocked from doing what technologically is not very hard to do. I think if we could just unblock that process, the rollout will continue.

[00:17:38] Doyne Farmer: We are going to need to do things like build pipelines for the fuels that we have, we may be able to just repurpose some oil pipelines, but we may need to build some new ones. Those are pipelines for ammonia, maybe hydrogen. Hydrogen is a little harder to ship around because it’s very leaky. And we need to remove the political barriers of incumbents.

[00:18:01] Doyne Farmer: You know, in Alabama, the utility regulation is set up to make it very hard for renewables to participate. So, we’ve got to somehow break through these political barriers to let everything roll out. So far, we’ve been able to get there by, you know, states like California have been very avant garde, and so the exponential right up has been from the easy places to do these things.

[00:18:32] Doyne Farmer: It’s also easier when you’re still only at a few percent, but as these become mainstream, it’s going to be important to remove the roadblocks.

[00:18:40] James Lawler: Right. One dynamic that would be playing in favor of renewables expansion would just be the increasing proof of the business case. It becomes, you know, pressure on the political infrastructure to remove the blocks.

[00:18:55] Doyne Farmer: Yeah. That’s, I think, probably the most important punchline of our paper. Is that, you know, we could do it cheaply, and in fact, even if you’re a climate denier, even for a climate denier, if you really are willing to just look at the economics, it’s cheaper.

[00:19:12] Doyne Farmer: So, there’s every reason to do it. Even if you’re a climate denier. It adds a lot of power to the argument that, why are we waiting around? Why don’t we make it happen? Because the biggest resistance is coming from the incumbents, you know, from the fossil fuel companies who don’t want to let go of their franchise and are very worried about going out of business as a result. A lot of them probably will.

[00:19:39] Doyne Farmer: So, you know, I’m shorting oil companies, but I think, to go back to your question, is that energy storage is critical. That’s the weak link right now. We really need to boost hydrogen-based fuels in particular. To make sure that we keep that, that is the most critical thing of all. Because once solar and wind start to be above 50 percent of the power generation, then you really need storage to make sure that the power is reliable.

[00:20:11] James Lawler: I wonder if we could talk a little bit about carbon capture and storage (CCS). You say in the paper that within a few decades, electricity produced with CCS will likely not be competitive. Even if CCS is free. Why is that? And where do you see carbon capture and storage in the coming years?

[00:20:28] Doyne Farmer: Let’s distinguish two kinds of carbon capture and storage. One kind is the kind we’re referring to there, which is that the way you produce electricity is, you burn the coal or the gas, you put a scrubber in the smokestack that takes the carbon dioxide out before it’s released into the air, and then you take the carbon dioxide that you have, and you put it in a form where you can inject it deep underground, where it won’t come back out. And the reason we’re saying that’s dead on arrival is because from our projections, it’s very likely that renewables are going to be cheaper than coal or gas.

[00:21:11] Doyne Farmer: So, okay, carbon capture and storage is just going to add to the cost. It’s just uneconomical. Period. Now, there’s a different kind of carbon capture and storage that we’re probably going to do, and I think the question is what will it cost, which is to take it out of the air.

[00:21:30] Doyne Farmer: Now, that’s harder than taking it out of a smokestack because the carbon dioxide is not as concentrated, but we will want to do that in order to suck back out the one and a half degrees of warming that we’ve already put into the atmosphere.

[00:21:48] Doyne Farmer: So, we may decide we want to take that back out. There, we will be aided by having very cheap electricity to drive that process. I think the jury is out as to what that will ultimately cost. How many dollars per ton will that be?

[00:22:06] James Lawler: And what’s the timeframe do you think for the total transition of the power generation sector, or electricity generation?

[00:22:16] Doyne Farmer: So, if the Fast Transition holds up, we’re really, in 20 to 25 years, we’ve pretty much done the whole thing. Carbon emissions go down close to zero. We’re talking globally.

[00:22:32] Doyne Farmer: Now, of course the political situation is very complicated. China has a million coal workers who have some power, and so really getting this done requires shutting down all those coal plants and coal mines, and reintegrating people into other activities. There is a lot to be done there, but the hopeful thing is that economics will be able to drive a lot of this.

[00:23:02] James Lawler: So, what do you think that the investor community, people whose job it is to deploy capital, what should they understand about your research that perhaps not enough of them understand?

[00:23:16] Doyne Farmer: We’re actually writing a paper on trying to predict when the fossil fuel industry will collapse and, if you believe in our fast transition, then it tells you that the fossil fuel industry is going to collapse in the next 20 years, and it’s going to start to collapse in the next 10 pretty dramatically.

[00:23:38] James Lawler: Don’t put your money there.

[00:23:44] Doyne Farmer: I mean, I sure wouldn’t be investing in it, and, you know, it’s crazy to build new infrastructure for fossil fuels at this point. There’s going to be a lot of sunk costs because ultimately lit’ll be cheaper to just realize the sunk costs, because it’s cheaper to just shut down an old coal plant and replace it with a renewable plant because the operating expenses of the coal plant, the operating plus the cost of the coa, is going to be more expensive than buying a new solar photovoltaic, a farm, and the corresponding storage capacity. So yeah, I think for investors, there still is not a full realization of the favorable economics of renewables.

[00:24:37] Doyne Farmer: By the way, the other thing that I think may be a big change is renewables may make energy prices much more stable. You know, oil has swung between, I think in 1998, it got all the way down to $11 a barrel, and it’s now over $100, so it’s been swinging through a big range and I think we’ll see much steadier energy prices.

[00:25:04] Doyne Farmer: Steady energy prices are a good thing because volitility is difficult to deal with. It allows people to plan their activities better.

[00:25:16] James Lawler: Wondering if, you know, infrastructure lasts a long time, and the question is: will the fast transition be too fast for existing infrastructure that’s being built, which might result in stranded assets?

[00:25:29] Doyne Farmer: It’s worth realizing that we’re replacing infrastructure all over. We spent time looking at stuff like, what’s the average lifetime of a gas station, right? What’s the average lifetime of a power line? What’s the average lifetime of a pipeline? So, those things have to be replaced at regular intervals too, and we’re replacing them on an ongoing basis. So, that combines with the fact that, so let me just make a statement, if the typical time is 25 years, if you’re turning over all the infrastructure every 25 years, then if we’re going to make the transition in 25 years, that gives us time to replace all the infrastructure. We just stop building new fossil fuel infrastructure, and we build renewable infrastructure instead.

[00:26:17] Doyne Farmer: It helps also that if we go on increasing global energy consumption at 2 percent per year, that gives additional turnover, right? Because that’s new stuff that we’re building. So, in other words, an increasing fraction comes from that, and realize also that a lot of the energy growth is coming, not from the United States, it’s coming from all the countries that are developing, that are starting to use more energy as their standard of living goes up. That increasing energy use is something that’s going for some good things, but yes.

[00:26:49] Doyne Farmer: Now, we may end up having to strand some assets despite that, if we don’t get going now, but we don’t think it’ll be that bad because of the arguments I just made, and we go through all that in some detail in the supplementing material of our paper. It’s a very good question.

[00:27:13] James Lawler: Well, Dr. Farmer, thank you so much for joining us today. It’s really been a pleasure to talk with you and very interesting, so thank you.

[00:27:21] Doyne Farmer: You’re welcome. Thank you.

[00:27:29] James Lawler: That was Dr. Doyne Farmer of Oxford University, and to sum up the conversation, it sounds like wind and solar are on a cost curve to continue getting cheaper and could replace fossil fuels in the next 25 years, but if policies block grid expansion, that would end up being more costly for all of us. Renewables are simply cheaper.

[00:27:51] James Lawler: To read Doyne’s paper, check out our other interviews, or watch our videos, visit climatenow.com. If you’d like to get in touch, email us at contact@climatenow.com. Climate Now is made possible in part by our science partners like the Livermore Lab Foundation. The Livermore Lab Foundation supports climate research and carbon cleanup initiatives at the Lawrence Livermore National Lab, which is a Department of Energy Applied Science and Research Facility.

[00:28:15] James Lawler: More information on the foundation’s climate work can be found at livermorelabfoundation.com. That’s it for this episode of the podcast, and we hope you join us for our next conversation.